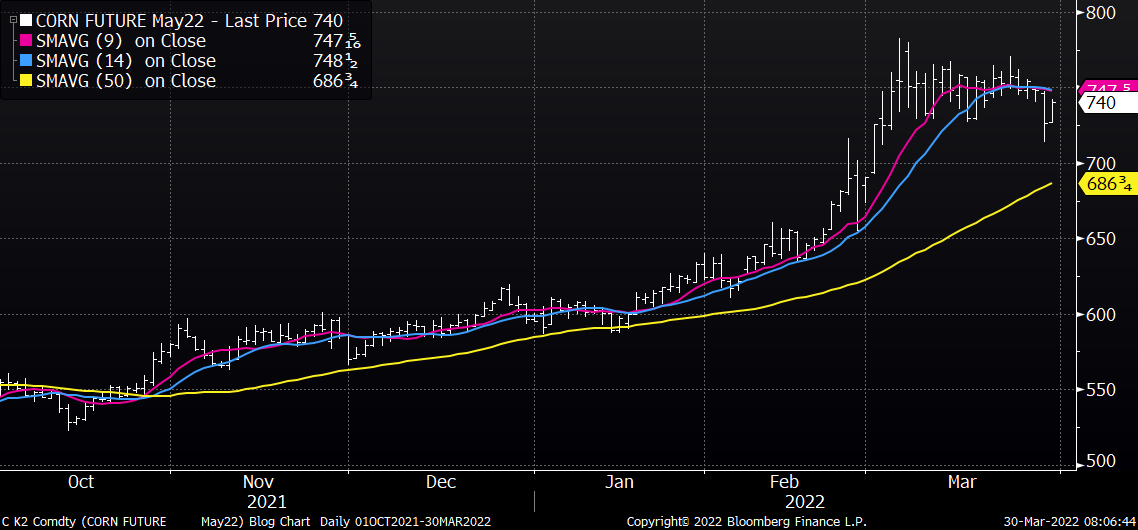

CORN: Production Concerns Persist Even if Cease-Fire Soon

Take a Free Trial of our Daily Comments, Weekly Market Letter and more! Subscribe today or Learn More

If a cease fire occurs soon, Ukraine will need help from other countries to get the fertilizer and seeds needed to restore its farming output and crucial exports to the rest of the world, according to the head of the World Bank. Ukraine would be helped by fertilizer from Western Europe to replace imports of that key agricultural input from Belarus that have been cut off. May corn closed sharply lower on the session yesterday, but managed to close up from the lows. The early selling drove the market down to the lowest level since March 2nd. News that Russia promised to scale down military operations around Ukraine's capital and north was seen as a bearish force as traders see a quick path to a ceasefire. Weakness in other grain markets and a further sharp break in energy plus a rally in the stock market were all seen as negative forces and help confirm ideas of a more back-to-normal market this year. A sharp drop in the US dollar was a partial offset to help support. Argentine gas stations are selling a maximum of 15 liters of diesel per customer. The rationing could be a factor which limits harvest activity.

In addition, fears of a fertilizer shortage could be a factor to reduce fertilizer usage and production for key producers. Russia is Brazil's main supplier of fertilizers, and the war in Ukraine is leading to fears that crop nutrient shipments will be disrupted. For the USDA Planted Acreage and March 1st Stocks report, the average trade expectation is 92.0 million acres (range 90-93.5 million), down from 93.4 million last year but in line with the USDA Outlook Forum estimate. March 1 corn stocks are expected to come at 7.864 billion bushels (7.316-8.087 range), up from 7.696 billion bushels last year. For the weekly ethanol production report, traders see ethanol production at 1.037 million barrels per day, 1.025-1.051 range, as compared with 1.042 million last week. Ethanol stocks are expected near 26.285 million barrels, 25.996-26.648 range, as compared with 26.148 million last week.

MARKET IDEAS

The market remains vulnerable to increased volatility as fund traders hold a huge net long position ahead of the USDA reports, and ahead of a possible cease-fire agreement. July corn support is at 713 ¾ and 695 ¼, with resistance at 726 ½. Clearing resistance turns the charts bullish again with 767 ½ as a longer-term target. December corn support is at 649 ¾ and 641, with resistance at 661 ½. Clearing resistance would leave 699 ¼ as upside target.